The growing need for effective financial management and optimization of the tax system requires an in-depth analysis of international experience and its impact on the Ukrainian economy. The experience of developed countries can become a source of helpful insights for developing effective financial stabilization strategies. Moreover, it can contribute to the further development of the Ukrainian economy. The article aims to analyze fiscal measures in the European Union and their implications for the economy and socio-economic development. It also focuses on tools for ensuring stability and economic recovery in the context of war. The study involved analyzing literature sources, comparing fiscal policies in the EU and Ukraine, generalizing the principles of implementing fiscal measures during wartime, systematizing aspects of economic recovery during the conflict, and analyzing statistical data to determine the impact of fiscal policy on finances. The current development of fiscal policy in the European Union is focused on increasing taxpayer loyalty and reducing the tax gap by improving tax administration and control. In turn, Ukraine is implementing measures to ease tax liabilities and simplify payment procedures. However, during the war, the use of market-based fiscal policy mechanisms may be challenging. Therefore, the state needs to search for alternative ways to manage finances and the economy to ensure stability and recovery. In this context, the use of fiscal reserves turned out to be a key to boosting fiscal policy under martial law. Under martial law, fiscal policy remains a key instrument for ensuring financial stability and development. It aims to support the economy, address challenges such as military conflict, and adapt to global threats. In this context, fiscal measures should be adequate, fair, and coordinated with other social policies to ensure sustainable development and social justice.

Due to the current global economic instability and geopolitical tensions, the development of an effective fiscal policy is becoming an essential component for ensuring the country’s sustainability and growth. The European experience in the field of fiscal measures is a vital source of lessons and examples that may be useful for Ukraine. Fiscal measures in many European countries aim to ensure financial stability, supporting economic growth and social development. For example, the implementation of an effective taxation system, public debt control, the development of social protection programs, and investments in vital sectors of the economy are just some of the measures that are used.

However, Ukraine has its own specific conditions and challenges that require a unique approach to the formulation and implementation of fiscal policy. For example, reforming the tax system, fighting corruption, and improving the efficiency of public financial management can be considered top priorities. The study of the European experience can help Ukraine choose the best ways to develop its fiscal policy, taking into account international standards and best practices. At the same time, it is necessary to consider the specifics of Ukrainian society and economy to ensure the maximum efficiency and acceptability of measures for the population and business.

This article aims to study and analyze the fiscal measures applied in the European Union, as well as their consequences for the economy, finance, and socio-economic development. In addition, it is crucial to identify fiscal instruments that can be used to ensure stability and economic recovery during the war. In addition, it is also essential to suggest possible ways to reform fiscal policy to achieve the state’s strategic goals in the context of the political and economic crisis.

The study by Kanieva and Stadnik [1] analyzed modern scientific approaches for defining fiscal policy as a tool for influencing economic development. The authors examined the experience of formulating fiscal policy measures in different types of economies and determined the tools for its implementation. The authors also assessed the potential and prerequisites for using the relevant instruments to ensure sustainable economic growth and improve social welfare. The study also identified the peculiarities of fiscal policy implementation at various stages of the economic cycle and under the conditions of socio-economic shocks.

While analyzing various aspects of fiscal policy, Kanieva et al. [2] have determined that the optimal level of taxation and tax structure vary depending on multiple factors and differ from one country to another. The authors found that both of these tax policy instruments could contribute to economic recovery and ensure the sustainability of economic growth.

In turn, Chugunov and Pasichnyi [3] studied the impact of the level and structure of taxation, budget expenditures, budget deficit, and public debt on economic development. Their findings indicate a significant effect of fiscal policy on economic development. They also highlight the need to develop and implement effective fiscal adjustment strategies to support sustainable economic growth.

In addition, Prots et al. [4] have identified the prospects for introducing digital technologies in the tax sphere to effectively deal with the shadow economy. The authors note that shadow economic processes pose a threat to the stability of the national economy and state financial activities. They also reduce budget revenues and impede the synchronized and balanced development of all sectors of the economy.

In their research paper, Kasych et al. [5] noted that these changes in the organization of production caused by digital innovations can also have an important impact on the fiscal policy of enterprises. The authors emphasize that the integration of digital tools into business processes can help to improve tax efficiency by ensuring accurate and transparent record keeping of financial transactions.

During the research, we have used the following methods:

literature analysis was used to define the concept and essence of the state fiscal policy, as well as to assess the role and impact of fiscal policy on the financial and economic situation of the country, in particular, to understand the strategic tasks facing fiscal policy.

comparative analysis was employed to identify similarities and differences between the fiscal policies of the European Union and Ukraine.

the generalization method was used to substantiate the principles and consequences of implementing fiscal measures in wartime and post-war conditions, in particular by analyzing tax policies and their impact on the economy of countries during war and military conflict.

the systematization method was utilized to assess various aspects of Ukraine’s economic recovery in the context of war and to identify possible ways to increase the state’s financial resources and diversify its economy to reduce the impact of military conflicts on economic stability and social development.

analysis of statistical data was employed to assess the effects of fiscal policy on tax revenues to the state budget, identify trends in the structure and dynamics of public expenditures, and study the impact of economic efficiency of investments in the context of fiscal policy.

Fiscal policy is a strategy for managing the financial resources of the state to ensure the adequate performance of its functions and tasks. Fiscal policy is implemented through the regulation of taxes, expenditures, social transfers, and subsidies. Each country sets its own priorities for social and economic development. These priorities are reflected in the choice of fiscal policy instruments. The main goals of fiscal policy include sustainable growth of national income, control of inflation, employment of the able-bodied population, and mitigation of economic cyclical fluctuations. Such goals define the main tasks of fiscal policy and are crucial in the context of ensuring economic stability and growth.

In addition, in the context of fiscal policy goals, monetary policy can contribute to price stability, control inflation, ensure liquidity in the national economy, and support economic growth [6]. These instruments are seen as fundamental management mechanisms of the anti-crisis strategy. Fiscal policy, in the context of financial crises, is a key element of the government’s response to economic difficulties. This policy aims to strengthen or stabilize the financial structure through the mechanisms of tax and budget policy. Therefore, its effects include:

Determining the level and structure of budget revenues and expenditures.

Setting optimal tax rates.

Implementing economic stimulus or restraint programs.

Since fiscal policy reflects the goals of the state in the field of finance, it becomes an integral part of the state’s anti-crisis strategy. Their effective use is crucial in ensuring stability and economic growth during a financial crisis [7].

The current development of fiscal policy in the European Union (EU) is determined by the interaction between the state and taxpayers. Favorable conditions for this interaction contribute to the effective fulfillment of fiscal tasks and the reduction of the shadow economy. The fact that European countries have earned the loyalty of taxpayers reflects the formation of a favorable interaction climate between them and the tax authorities. In addition, the reduction of the tax gap, i.e., the amount of unpaid taxes due to the shadow economy, caused by this level of loyalty is one of the main goals of fiscal policy. This can be achieved by improving the mechanisms of tax administration, increasing transparency in taxation, and applying effective methods of monitoring compliance with tax legislation.

Thus, there are three main priorities for interaction between an EU member state and its taxpayers. The first one includes providing advisory services to taxpayers and simplifying taxation procedures focusing on the substance of commercial transactions. The second priority involves the internationalization of taxation and the creation of common standards in this area. It also means the prevention of the shadow economy and aggressive tax planning activities through the introduction of appropriate measures and control mechanisms [8].

It should be noted that Ukraine is also implementing measures to create favorable conditions for taxpayers to ease their tax obligations and simplify tax payment procedures. The initiatives of the National Tax Administration of Ukraine include the following measures:

VAT refunds and registration of tax invoices.

the possibility of remote submission of reports on various taxes [9].

the creation of service centers for taxpayer services across the country.

development of information and electronic services through web portals.

introduction of electronic digital signatures.

creation of separate central offices for large taxpayers.

testing of the “Electronic Taxpayer Cabinet” [10].

The international experience of implementing fiscal measures under wartime and post-war conditions is based on the urgent need to finance growing military expenditures. It forces governments to take measures to increase the taxation of citizens [11]. For example, during World War II, nominal marginal income tax rates reached historic peaks of over 90% in the United States and the United Kingdom. Meanwhile, in Sweden, they tripled compared to the pre-war period, reaching almost 70%. Such changes led to a significant increase in budget revenues from income taxes, in particular in the UK, where their share in total tax revenues almost doubled to over 42% in 1945 compared to 24% in 1913 [12].

For the current realities of Ukraine, the International Monetary Fund recommends that countries experiencing military conflicts avoid non-transparent taxation systems and introduce a proportional tax scale. These measures are justified by the fact that in the context of limited tax control, this approach reduces the incentives for violations of tax legislation and helps to preserve the tax base. Some modern experts believe that tax liberalization during the war can be an effective measure to counteract crises [13].

Since the beginning of the full-scale invasion of Ukraine by the Russian Federation, the state has been facing a set of new challenges. Among these challenges are the destruction of infrastructure, shelling, occupation, business interruption, mass migration, logistical obstacles, humanitarian crises, and business shutdowns. These problems affect the entire country and its territories. Therefore, recovery from these losses requires significant financial resources [14]. Consequently, it should be noted that as of 2022, Ukraine’s GDP decreased by 25.5%, which reflects the enormous impact of military aggression on the country’s economy. It is important to note that the country did not meet the expectations of the International Monetary Fund, which predicted a 35% drop, and the World Bank, which also indicated a much larger decline in GDP – by 45

The Draft Recovery Plan of Ukraine emphasizes the importance of implementing a carefully balanced fiscal policy. In other words, the state should ensure an optimal balance between revenues and expenditures, avoiding excessive deficits or excessive burden on the budget. Also, one of the key aspects of economic recovery is to increase the spending efficiency. The introduction of financial control and audit is a tool to avoid expenses on unnecessary or inefficient projects and to ensure the efficient use of public funds. In addition, the improvement of the tax and customs system will further increase the state’s financial resources for investment in economic recovery and social development. Such enhancements include simplification of the tax system, anti-corruption measures in the area of customs payments, and more effective control over the payment of taxes and duties [8].

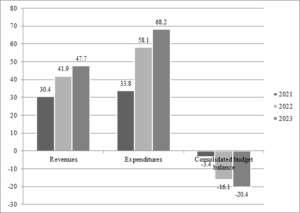

Currently, the state’s fiscal policy is becoming one of the key tools for managing the economy, especially in the face of a complex conflict. Such policy requires not only strengthening financial resources but also diversifying the economy to reduce the military impact on certain industries and regions. The optimization of using available resources and the search for new sources of income become important tasks during wartime. For example, it is possible to expand the fiscal space by developing economically active territories or attracting resources to the state budget that previously remained unused for various reasons. Therefore, taxes or government revenues (Figure 1) and government expenditures (Figure 2) should be seen as the main instruments of the fiscal policy of the state. However, during a war, the use of market mechanisms of fiscal policy can be significantly complicated. The high level of uncertainty and the risk of adverse external factors reduce the effectiveness of conventional fiscal policy instruments, causing financial difficulties. Therefore, under martial law, the state is forced to look for alternative ways to manage finances and the economy to ensure stability and recovery.

The fiscal policy analysis at the beginning of 2024 shows a significant impact of the indicators on tax revenues to the state budget. Total tax revenues in February 2024 amounted to UAH 117.6 billion. During the analyzed period, consumption taxes experienced a significant decrease of 29%, reaching the lowest level since June 2023 due to weak internal VAT revenues. However, such a decline was offset by corporate income tax revenues of UAH 34.7 billion, including a 50% tax on bank profits of UAH 26.1 billion. It is also worth noting the historically high revenues from excise taxes, which amounted to UAH 12.6 billion. These tendencies indicate the need for close monitoring of fiscal policy and timely response to taxation changes to ensure stability and efficient management of budgetary resources.

In turn, the analysis of the structure and dynamics of state expenditures in January 2024 indicates a significant reduction in funding. The total amount of funding fell to a new record low of UAH 158 billion, which is only 49% of the average monthly expenditures for 2023. Especially significant was the reduction in defense spending, which dropped from UAH 313 billion in December 2023 to UAH 65 billion in January 2024. In addition, expenditures on other functions decreased by 2-5 times, except for social security, which remained average. The downward trend in state budget expenditures indicates a possible restrained nature of the state financial policy and the need for close monitoring and optimization of spending to ensure effective management of budget resources in the future.

During the martial law period, Ukraine used various fiscal policy instruments to ensure financial stability and support the country in the crisis. In particular, the use of fiscal reserves proved to be key to revitalizing fiscal policy and turning it into a stimulating factor under difficult war conditions [15]. One of the key sources of state budget revenues were grants from international partners and non-tax revenues generated by voluntary transfers from individuals, businesses, and organizations to support Ukraine. These funds effectively compensated for a significant decrease in tax revenues and contributed to a slight increase in budget revenues [16].

The fiscal policy prioritized the search for financing instruments aimed at ensuring the country’s defense and security, social spending, increasing financial support for the military, and debt service [17]. Such measures were strategically crucial for maintaining financial stability and ensuring the effective functioning of the state in the context of military conflict (Table 1).

| Instrument | Description |

| Fiscal reserves |

Financial resources held by the government for use in case of emergencies or to

maintain the financial stability of the country |

| Revenues replenishment |

Increase in state budget revenues by increasing tax revenues through advance

payment of taxes by state-owned enterprises and banks |

| Additional revenues |

Additional funds received by the state budget in excess of the planned amounts,

usually as a result of taxes, fines, or other sources |

| Changes in tax legislation |

Such changes include changes in tax rates, taxation conditions, and other aspects

of taxation to regulate the country’s economy |

|

Increased expenses for

priority needs and reduction of other budget expenditures |

Higher spending on social programs and military salaries would help to support

household demand and mitigate the economic shock caused by the war. Instead, there should be significant cuts in other budget expenditures, such as capital expenditures and other programs, to focus on the highest priority areas |

| Support for social programs |

The use of various incentives, such as financial benefits and support for social

programs, to stimulate consumer demand and support the economy under martial law |

| Reduction of economic risks |

Activities aimed at reducing possible negative consequences for the country’s

economy due to external or internal threats, such as war, economic instability, etc. |

|

Agreement on the “grain

corridor” |

An agreement aimed at supporting the export of agricultural products and

transportation services, which contributed to the growth of budget revenues by increasing exports and supporting transportation infrastructure |

| Liberal tax reform |

A reform aimed at reducing the tax burden and simplifying the taxation system,

including the introduction of a simplified taxation system with a single-income tax |

|

Involvement of external

borrowings and monetary financing |

The use of external sources of funding through the purchase of military bonds

by the National Bank of Ukraine to meet the government’s financial needs and economic recovery |

As part of the fiscal policy adaptation to the current needs, the NBU applied fiscal regulation of the tax system. This includes the introduction of tax privileges, changes in tax rates, expansion of the use of simplified taxation systems for enterprises, and additional social benefits for the population. In this context, in March 2022, the Verkhovna Rada of Ukraine adopted the Law of Ukraine “On Amendments to the Tax Code of Ukraine and Other Legislative Acts of Ukraine Regarding the Validity of Provisions for the Period of Martial Law.” This law significantly impacts the tax system and fiscal regulation in the country. This draft law introduces significant changes to the Tax Code and other legislative acts to ensure financial stability and support citizens and businesses during martial law [18].

One of the key initiatives of this law is to expand the scope of the simplified taxation system for businesses with small annual revenues. Currently, the simplified taxation system at the rate of 295 is available to business entities with revenues of up to UAH 10 billion, single taxpayers of groups 1-2 can voluntarily pay it, and individual entrepreneurs of groups 1-3 are entirely exempt from paying the single social contribution (SSC). These measures stimulate the development of small enterprises and support their competitiveness, allowing them to focus on business and recovery during the crisis. Additional benefits for individual entrepreneurs and self-employed citizens are also an essential element of this law. The exemption from the unified social tax for entrepreneurs and the provision of tax benefits reduce the financial burden on these categories of people and encourage the support of business in the face of uncertainty. Also, such tax changes aim to increase social responsibility and support for those in difficult life circumstances. For example, the tax exemption of charitable aid for combatants and people living in conflict-affected areas helps to provide social support to vulnerable groups [19].

As part of analyzing the prospects for economic efficiency of investments in the context of fiscal policy, it is necessary to use the principles of rational economic behavior. This approach implies investing in areas where the expected income exceeds the resources used. It is worth noting that the assessment of the cost of increasing the level of economic productivity should also take into account the lost opportunities (lost income) that could have been obtained through alternative use of the invested resources [20]. It is necessary to assess the economic efficiency of investments in improving economic productivity by examining the dynamics of changes in the revenues, expenditures, and deficit indicators of the Consolidated Budget of Ukraine (Figure 3).

It should be noted that fiscal policy accompanied by a high level of budget deficit has a significant impact on the country’s socio-economic development. In Ukraine, such a policy is manifested in a decrease in both capital and foreign direct investment in the economy. At the beginning of 2024, the share of financing needs covered by foreign aid was the lowest since the beginning of the full-scale invasion and amounted to only 19%. The lack of financial resources in the state budget to meet the needs stipulated by law leads to the suspension of funding for certain expenditures, except for protected ones. The first step to overcome such negative consequences is to increase public revenues. This will be possible if the tax legislation is radically changed towards tax reduction, taking into account the relevant compensators [21].

We mostly agree with Kanieva & Stadnik [1] in their definition of the role of fiscal policy in regulating economic development. We share their opinion about the main elements of fiscal policy, as well as the importance of its adaptability in the context of the macroeconomic cycle and its balance in the long run. However, we believe that the study should be complemented by research on different approaches to prioritizing fiscal policy and its implementation in countries with various types of economies, as well as its role in state regulation of economic development.

We agree with Kanieva et al. [2] since their research confirms that the optimal level of taxation and tax structure indeed are significant factors that affect the economic development of a country. The authors point out that it is vital to take into account various economic, social, and political factors in order to develop an effective tax policy that will contribute to sustainable economic growth and recovery from crises. In addition, we believe it is advisable to use the authors’ recommendations on changes in the socio-economic environment, mainly due to the COVID-19 pandemic, to ensure economic resilience and social stability.

We also agree with Chugunov and Pasichnyi [3] about the significant impact of fiscal policy on economic development, which they found in their study. We recognize the relevance of the factors identified by the authors to economic processes and emphasize the importance of effective fiscal regulation for sustainable economic growth.

To some extent, we also agree with Prots et al. [4] on the importance of introducing digital technologies in the fiscal sphere to counteract the shadow economy. The authors emphasize that shadow economic processes threaten the stability of the national economy and financial activities of the state, as well as reduce budget revenues. However, we believe that it is also worth considering the potential challenges and limitations associated with the digital transformation of the fiscal system.

Finally, we agree with Kasych et al. [5] on the significant impact of digital innovations on enterprises’ fiscal policies. Their study confirms that the integration of digital tools can improve tax efficiency by providing a more accurate recording of financial transactions and promoting compliance with tax legislation. This approach helps to optimize tax payments and contributes to companies’ stability and development.

During the war, fiscal policy remains one of the key instruments for managing the economy and ensuring its stability in the face of global challenges. In Ukraine, as in many other countries, such policy aims to provide financial stability, stimulate economic growth and social development, and address pressing issues such as military conflict. In light of current challenges and threats, including the pandemic, the outbreak of a full-scale invasion, and economic and political instability, fiscal policy is a key tool for addressing and adapting to them. Such policies should take into account the needs of society, support entrepreneurship, ensure the stability of the financial system, and promote economic recovery. The fiscal policy should be adequate, fair, and consistent with other economic and social policies of the state. This will help to balance development needs and financial sustainability while ensuring social equity and inclusive development.