Contemporary crisis phenomena, including financial, structural, political, and social aspects, underscore the need for effective fiscal policy to ensure the resilience and development of the country. Additionally, there are currently complex challenges related to the war, such as infrastructure destruction, business shutdowns, and mass migration, which have significantly impacted the country’s economy and require additional financial resources for recovery. This situation necessitates the search for new sources of income and the optimisation of existing resources, highlighting the importance of effective tax regulation to overcome economic challenges during conflict. This scientific article aims to determine the role of fiscal policy in ensuring effective economic development, as well as the importance of tax instruments and their efficiency in promoting economic growth and optimising financial resources. In the research process, literary sources were analysed, and statistical data was scrutinised to evaluate the dynamics of state revenues and expenditures and the impact of tax receipts on the state budget. The study emphasises the importance of tax instruments for economic development and meeting the country’s financial needs. The efficient use of tax instruments facilitates the collection of sufficient revenues to fund social and economic needs. The study highlights the importance of employing the necessary tax instruments to ensure the country’s effective economic development. In martial law conditions, mobilising fiscal reserves and activating tax instruments become critical strategies for ensuring financial stability and supporting the economy. However, the successful implementation of these measures requires the improvement of the organisational structure and administration. A balanced approach to tax burden, a conducive environment for business, and the development of new revenue sources are critical in ensuring financial stability and supporting economic growth during conflict.

ffective fiscal policy becomes critical for ensuring the country’s resilience and development in the context of contemporary global economic instability and geopolitical tensions. Various crisis factors, including financial, structural, political, and social aspects, underscore the need for adequate tax revenue in the budget. An effective fiscal policy should stimulate the growth of budgetary revenues, distribute them rationally, and utilise them efficiently, thereby increasing trust in fiscal administration and its conformity with modern requirements.

Since the beginning of the full-scale invasion by the Russian Federation into the territory of Ukraine, the state has faced a multitude of complex challenges, including infrastructure destruction, shelling, occupation, cessation of business operations, mass migration, logistical barriers, humanitarian crises, and business closures. These problems have significantly impacted the country’s economy and provoked financial expenditures that will require the mobilisation of additional resources for rapid and effective country recovery. In such circumstances, the tax instruments of fiscal policy become the primary driver of strategic economic management, particularly in a complex conflict. Moreover, this necessitates strengthening financial resources and expanding economic diversity to reduce the vulnerability of specific sectors and regions to the impact of war. Optimising the use of existing resources and seeking new sources of income become critical tasks during conflict.

This article aims to ascertain the role of fiscal policy in ensuring effective economic development. Moreover, analysing the existing problems and challenges associated with utilising fiscal policy mechanisms and tax instruments is necessary. In this context, it is essential to identify the necessary tax instruments and their effectiveness in stimulating economic growth and optimising financial resources.

In their scholarly work, Martynova and Shedko [1] considered the importance of an effective fiscal policy for ensuring the viability of Ukraine’s socio-economic system at this stage and creating the preconditions for its integration into the post-war international economic space. The authors examined the role of the taxation system as an essential tool for forming budgetary resources to fulfil various state functions. It was emphasised that an effective tax system must be balanced, considering the state’s and taxpayers’ interests. The researchers focused on the notion that tax regulation should include a comprehensive set of organisational, legal, regulatory, and control measures that directly impact the population’s standard of living. They also noted that tax policy contributes to the observance of social justice and ensures the progressive social development of society.

Furthermore, Kryvonos [2] elucidates the pivotal elements of fiscal policy instruments, particularly in financial regulation and optimising the tax burden, to ensure sustainable economic development. Osadchuk’s work [3] established the significance of applying tax instruments to develop territorial communities successfully. The author emphasises the importance of local self-government bodies considering the community’s specific characteristics and concrete issues when formulating their development strategies. The author believes that using tax instruments is an effective means of enhancing the economic potential of territories, stimulating the initiation and expansion of entrepreneurship, and enhancing their competitive advantages.

In turn, Kriukova et al. [4] investigated the role of taxation in achieving sustainable development goals as a vital instrument of the state management mechanism that influences economic development and the population’s well-being. Furthermore, a comprehensive analysis of the structure of tax revenues of the State Budget was conducted, assessing their dynamics and impact on the country’s economic situation. The study also delineated the principal avenues for further enhancement of the national tax system following the tenets of sustainable development, with due consideration of the prevailing issues and obstacles. The research broadened the comprehension of the ramifications of tax influence on the economy and social advancement, furnishing pivotal conclusions and counsel for reinforcing the tax system in the context of ensuring sustainable economic growth of the country.

The following methods were used in the study:

a literature analysis was conducted to assess the role of tax instruments in fiscal policy, the peculiarities of their impact on economic development and the formation of budgetary resources;

the systematisation method was used to analyse fiscal measures during martial law and to evaluate their effectiveness aimed at ensuring financial stability and economic recovery after the losses caused by the war;

analysis of statistical data was applied to estimate the dynamics of state revenues and expenditures of Ukraine, as well as to identify the impact of tax revenues on the state budget and to analyse the structure of expenditures;

the generalisation method was implemented to review tax instruments in fiscal regulation as part of the adaptation of fiscal policy to the current needs and challenges of martial law.

In the current conditions of rapid transformations in Ukraine’s economy, characterised by a confluence of crises (financial, structural, political, social, and conjunctural), the imperative to ensure adequate tax revenues in the budget has become pressing [5]. The resolution of this problem hinges on the efficacy of fiscal policy, which should stimulate the growth of budget revenues, distribute them rationally, and utilise them effectively, thereby enhancing trust in fiscal administration and its compliance with contemporary requirements.

Fiscal policy represents a set of measures the state implements to regulate economic processes by manipulating tax burdens and state expenditures. The main goals of fiscal policy are to ensure a proper level of employment, restrain inflation, and smooth out cyclical fluctuations. It is an effective tool that allows the state to influence macroeconomic indicators and ensure stability in the economic system [6]. Fiscal policy involves creating financial resources for the state by collecting taxes. These resources are accumulated in the budgetary system and off-budget funds, which are necessary for performing a wide range of state functions, including economic, defence and social. In this context, effective fiscal policy in Ukraine should ensure the socio-economic system’s viability in contemporary conditions and create the necessary preconditions for the country’s successful integration into the international economic space [7]. Fiscal policy objectives include sustainable growth of national income, inflation control, employment of the working-age population, and smoothing of economic cycles. These objectives define fiscal policy’s main tasks and are vital to ensuring economic stability and growth. Moreover, within the context of fiscal policy goals, monetary policy can contribute to achieving price stability and inflation control, ensuring the liquidity of the national economy, and supporting economic growth [8].

The tax instruments of fiscal policy serve as one of the most important means of regulating a country’s economic development. Furthermore, they exert a considerable influence on the extent of state budget revenues, affecting the state’s capacity to finance its social, economic, and infrastructural requirements. The efficacious utilisation of tax instruments enables the state to amass sufficient income to fulfil its obligations, including providing education, healthcare, social protection, and infrastructure projects (see Table 1). Furthermore, tax policy stimulates economic growth by providing benefits and incentives for entrepreneurship investments and innovations in the business sector. However, it is necessary to balance the tax burden so that it does not hinder the development of economic processes and entrepreneurial activity. Excessive taxation will lead to business downturn, loss of competitiveness, and decreased investment climate.

| Tool | Features |

| Personal income tax (PIT) | It affects consumer activity and living standards. Reducing personal income tax rates can increase the availability of money for spending and increase consumer solvency. |

| Corporate income tax (CIT) | Corporate income tax affects economic development by stimulating or discouraging investment and entrepreneurial activity in a country. Reducing the corporate income tax rate can promote business growth and create new jobs. |

| Value added tax (VAT) | The value-added tax affects the country’s production and consumption of goods and services. Setting the rates of this tax impacts the price competitiveness of goods in the market. |

| Taxes on international trade and external transactions | Such taxes include import and export duties, consular fees and other revenues from foreign economic activity. They affect economic development by regulating the country’s foreign economic activity. Imposing customs tariffs and other tax barriers can encourage or discourage international trade and foreign investment. |

| Rent payment | Rent is charged for using subsoil, radio frequency resources, water, forests, and other country resources, as well as for transporting oil, oil products, and ammonia through Ukraine’s territory. This tax stimulates the restoration and rational use of the country’s natural resources. The regulation of this tax may also affect the production and development of industries related to the extraction of mineral resources. |

| Excise tax | An excise tax is a specific form of taxation of industrial goods that is applied when they are produced for domestic consumption rather than when they are sold. It influences consumer and producer choices by promoting changes in consumption patterns and production models. |

| Investment incentives | For instance, exemptions from value-added tax and income tax or exemptions from import duties. Such incentives affect the level of investment and the development of specific sectors of the economy, stimulating innovation and the development of new technologies. |

Source: compiled by the author based on [9-13]

In the context of martial law in Ukraine, fiscal policy assumes a pivotal role, particularly in light of amendments to the Tax Code and introducing a mini-tax reform to improve the economic situation during the war period [14]. However, the effectiveness of the main fiscal policy instruments during martial law in Ukraine has been limited. There is considerable uncertainty surrounding their market efficacy, complicating their implementation in the usual format. From 24 February 2022, the government implemented measures to ensure financial stability, including utilising fiscal reserves. The National Bank of Ukraine transferred a portion of its revenues to the state budget for 2021, while numerous enterprises prepaid their taxes. Consequently, in March 2022, the state budget’s revenues were augmented by advance payments from state-owned enterprises and banking institutions. Nevertheless, the fiscal reserves were depleted, and the execution of the state budget revenues became extremely tense, leading to the revenues being just over half of the pre-war level [15].

Since the commencement of the full-scale invasion by the Russian Federation into the territory of Ukraine, the country has been confronted with a multitude of intricate challenges, including the destruction of infrastructure, shelling, occupation, cessation of enterprise operations, mass migration, logistical obstacles, humanitarian crises, and business closures. These problems have affected the country and its territories, especially in the combat zone, leading to substantial financial expenditures for recovery after the losses above [15]. It is evident that by the end of 2022, Ukraine’s GDP had decreased by 29.1%, which illustrates the considerable impact of military aggression on the country’s economy [16]. Consequently, the forecasts of the International Monetary Fund and the World Bank proved less pessimistic than the actual situation, as they predicted a more significant decrease in GDP than what occurred.

The Ukraine Recovery Plan project emphasises the necessity for a balanced fiscal policy whereby the state will ensure an optimal balance between revenue and expenditure, thus avoiding excessive deficits or strain on the fiscal system. Moreover, an essential aspect of economic revival is increased spending efficiency. Implementing financial oversight and audit mechanisms is a bulwark against the wasteful use of resources on unnecessary or ineffective initiatives, ensuring the prudent use of state funds. Furthermore, strengthening the tax and customs apparatus will increase the state’s financial reserves, which will facilitate investments in the recovery of the economy and social development. Such improvements encompass optimising tax infrastructure, combating corruption in customs protocols, and increasing the efficiency of control over tax and duty remittances [17], [18].

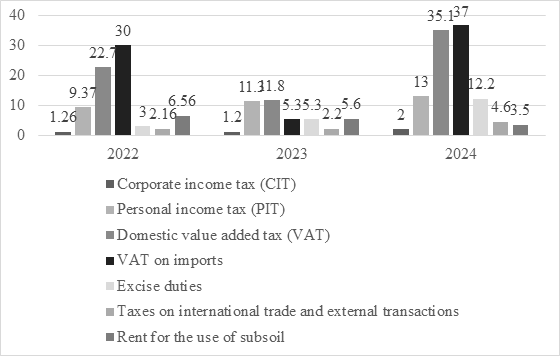

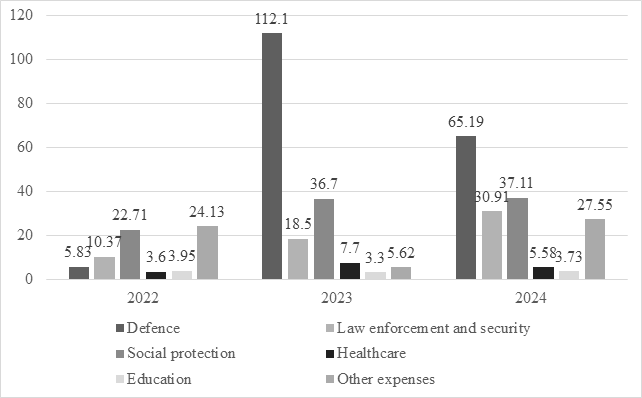

The state’s fiscal policy is transforming, becoming a strategic tool for managing the economy, especially in wartime conditions. It necessitates not only the strengthening of financial resources but also the diversification of the economy to reduce the vulnerability of specific sectors and regions to the impact of war. During a period of conflict, optimising the use of existing resources and searching for new sources of income become vital tasks. For instance, fiscal space may be expanded by developing economically active areas or bringing previously unused resources into the state budget. Consequently, the principal instruments of the state’s fiscal policy are taxes or state revenues (see Figure 1), as well as state expenditures (see Figure 2) [19]. However, in wartime conditions, the utilisation of market mechanisms of fiscal policy may become complicated. The high level of uncertainty and the risk of harmful external factors can complicate the effectiveness of traditional fiscal policy instruments, leading to financial difficulties. Consequently, in wartime conditions, the state must seek alternative avenues for managing finances and the economy to ensure stability and recovery [20].

The analysis of the dynamics of state revenues reveals the significant impact of tax revenue indicators on the replenishment of the state budget. In February 2024, tax revenues amounted to 117.6 billion UAH. In particular, consumption taxes decreased by 29%, reaching the lowest mark since 2023. This decline was primarily due to decreased VAT revenues from the domestic market. However, this decline is offset by revenues from the corporate income tax, which amounted to 34.7 billion UAH, including the bank profit tax (26.1 billion UAH), which is 50% more than the previous year. Moreover, the high revenues from the excise tax, which amounted to 12.6 billion UAH, are noteworthy. Such trends underscore the necessity for meticulous fiscal policy monitoring and expeditious adaptation to alterations in the tax environment to reinforce stability and guarantee efficacious budget administration. A comprehensive examination of the structure and dynamics of state expenditures reveals a precipitous decline in funding to an unparalleled low point in 2024 (158 billion UAH), representing only 49% of the average monthly expenditures for 2023. Notably, the decline in defence spending was particularly pronounced, from 112.1 billion UAH in 2023 to 65.2 billion UAH in 2024.

Additionally, expenditures in other sectors decreased significantly, except social security, which remained relatively stable [22]. This downward trend in state budget expenditures suggests a potential shift towards a more conservative fiscal policy, which will require vigilant oversight and strategic spending optimisation to ensure balanced management of budgetary resources in the future.

During martial law in Ukraine, fiscal policy has proven essential for ensuring financial stability and supporting the country amidst the crisis. One of the fundamental mechanisms used involved the mobilisation of fiscal reserves and their activation to stimulate economic activity and provide financial backing for the state. It was achieved through several measures, including revising tax policy, maximising resource use, and efficient budgetary fund utilisation [14]. One of the principal sources of revenue during the war has been grants from international partners and voluntary transfers by citizens, businesses, and organisations to support the country. These funds have effectively compensated for reduced tax revenues and improved the state’s financial situation [23]. Moreover, fiscal policy prioritised identifying financing instruments to ensure the country’s defence and security, social expenditures, enhancing the financial provision of military personnel, and debt servicing. Such measures are crucial for maintaining financial stability and ensuring the state’s effective functioning in military conflict conditions. Their carefully designed and implemented strategies have contributed to financial resilience and strengthened trust in the country’s economic management [24].

In order to adapt fiscal policy to current needs, the National Bank of Ukraine implemented fiscal regulation within the tax system. It included the introduction of tax incentives, the adjustment of tax rates, the expansion of simplified taxation systems for businesses, and the provision of additional social benefits to the population. In particular, in 2022, the Verkhovna Rada of Ukraine adopted the Law of Ukraine ’On Amendments to the Tax Code of Ukraine and other legislative acts regarding the period of martial law’, which provides for significant changes to the tax system and fiscal rules to support financial stability and provide support to citizens and businesses during martial law [25].

Consequently, fiscal policy is integral to Ukraine’s national security and defence capability during martial law. One of the critical tasks in this area is the implementation of tax instruments and preventative measures to ensure effective management of financial resources (see Table 2). Tax instruments are essential in budget formation and meeting the country’s defence and security needs. It is also important to note that ensuring financial resources to redirect social expenditures is necessary. It includes not only new initiatives, such as the ’e-Support’ programme and assistance to internally displaced persons, but also the financing of existing social programmes that provide various types of assistance, benefits, and subsidies to the population for housing and utility payments [26].

| Measures | Description |

| Exemption from liability in case of impossibility to fulfil an obligation | Taxpayers are exempt from liability if they cannot promptly fulfil their tax liability, provided this occurs during martial law or war. |

| Moratorium on tax audits | There is a temporary prohibition on conducting any tax audit during martial law or war. |

| Suspension of deadlines stipulated by tax legislation | The deadlines established by tax legislation for various tax obligations are suspended for martial law or war. |

| Extension of licences | Licences to carry out certain types of activities are automatically extended during martial law. |

| Exemption from sanctions for violation of requirements for using registrars | Taxpayers are not subject to sanctions for violation of the requirements to use payment transaction recorders during the period of martial law or war. |

However, it should be noted that the implementation of the mentioned tax changes requires further improvements in the organisational structure to optimise administration processes. In particular, acknowledging the accumulative character of turnover taxes is decisive, as they can place an excessive burden on the production of complex technological goods. A potential solution to this problem is the differentiation of unified tax rates depending on the nature of the economic activity or specific categories of goods. To prevent the depletion of financial reserves of local budgets, which were previously replenished from the receipts of the single tax from individual entrepreneurs, we suggest complementing the national turnover tax rate of 2% with a locally regulated rate (for example, in the range of 0.25% to 1.5%), which can be determined by the regional military-civil administrations, considering the regional characteristics, financial needs of local budgets, and the intensity and consequences of military actions. Moreover, effective tax incentives and a regulatory basis for entrepreneurs must be accompanied by real possibilities for relocating production capacities from conflict zones, acquiring necessary equipment, protecting production areas, and restoring supply chains and distribution networks. Achieving business resilience in wartime necessitates practical recommendations from crisis management experts and state support measures [29].

We agree with the study by Martynova and Shedko [1], as it highlights the importance of effective fiscal policy for ensuring the viability of Ukraine’s socio-economic system and creating the prerequisites for its successful integration into the international economic space after a period of military conflicts [30]. According to the study’s findings, the taxation system is a vital tool in forming budget resources for the state to perform its functions. The authors emphasise the necessity of a balanced tax system that considers the state’s and taxpayers’ interests. Therefore, tax regulation should include measures to support social justice and progressive social development.

We concur with Kryvonos’s [2] assertion that tax policy is vital in economic management and ensuring the state’s financial stability. However, to achieve maximum effect, various aspects of tax policy, including promoting a fair distribution of income and the sustainable development of society, must be considered.

We agree with Osadchuk [3] conclusions on the importance of applying tax tools to develop territorial communities successfully. Focusing on the necessity of considering the specifics and concrete problems of the community by local self-government bodies allows us to understand that uniform approaches are only sometimes practical for different regions. Consequently, considering such characteristics is essential for forming their development paths. The effective use of tax tools can significantly contribute to strengthening the economic potential of territories, stimulating entrepreneurship, and enhancing their competitiveness [31,32].

We partially agree with the findings of Kriukova et al. [4], since the role of taxes as a vital tool of state management lies in its impact on economic development and the population’s well-being. Furthermore, we agree that considering current problems and challenges, developing and implementing directions for improving the domestic tax system based on sustainable development is essential. However, it is necessary to expand the understanding of the processes of tax impact on the economy and social development to effectively use tax instruments to ensure the country’s sustainable economic growth.

In the contemporary context, the tax toolkit of fiscal policy is a crucial component for achieving effective economic development in any country. The state uses the aggregate of taxes, tax rates, exemptions, and other fiscal instruments to regulate economic processes and collect revenues to finance its functions. In the context of a state of war, fiscal policy becomes even more critical, as Ukraine has faced several complex issues due to aggression from the Russian Federation, requiring immediate government response. In such circumstances, the effective use of tax instruments becomes critical for ensuring financial stability and supporting the economy.

The research results indicate that mobilising fiscal reserves and activating tax instruments are critical strategies in conflict conditions. These include reviewing tax policy, changing tax rates, providing incentives for businesses and the population, and expanding simplified tax systems. However, organisational structure and administration improvement is necessary to implement these measures successfully.

The efficacy of fiscal policy during wartime is contingent upon its capacity to guarantee financial stability, stimulate economic activity, and ensure optimal resource utilisation. In this context, fiscal policy necessitates a balanced approach to tax burden to preclude hindrances to business development and the investment climate. It also involves the development of new revenue sources and the expansion of fiscal space. Consequently, an analysis of the evolution of the tax toolkit of fiscal policy in Ukraine reveals its pivotal role in maintaining financial stability and fostering economic growth in wartime contexts.